The Enron Scandal

- Ayush Bhupal

- May 11, 2021

- 3 min read

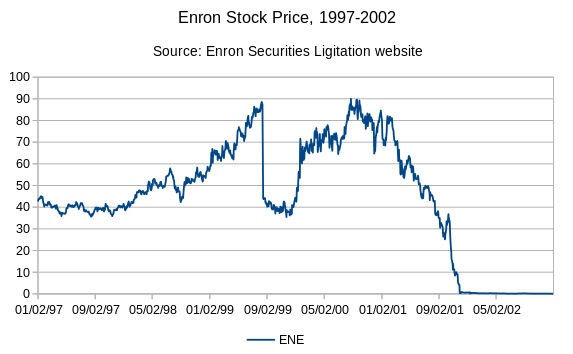

The Enron Scandal was one of the largest accounting scandals of the corporate world. Enron was primarily an Energy Company, but overtime it became involved in many other sectors. Their business was too intricate and complex for the average person to understand. In reality, it was all just a big scam. Enron was founded by Kenneth Lay as a merger between Houston Natural Gas and InterNorth, both small regional companies. At its peak, Enron’s shares were worth $90.75 which plummeted to $0.26 just prior to declaring bankruptcy on December 12, 2001. Fortune listed Enron as “America’s Most Innovative Company” for six consecutive years and was obviously very attractive to investors. Before declaring bankruptcy, Enron had about 29,000 employees; The shareholders lost as much as $74 billion and the employees lost millions in pension benefits.

Everything started with the arrival of Jeffrey Skilling, Enron’s new CEO and Lay’s biggest asset. He introduced the company to Mark-to-Market accounting. This accounting method values a company based on its current market price and not on the book price. It is a legitimate and widely used practice. But in some cases, such as this one, MTM can be manipulated since the method is not based on the ‘penny’ earned but on expected earnings. Suppose Enron signed a deal worth $50 million over the next ten years, then they could write $50 million in their books that day despite not having received a penny. It did not even matter if the deal went through. Effectively this meant that the company was worth more on paper than it had actually earned. All they had to do was project some earnings, and boom they had earnings.

Enron’s stock had tripled in the space of two years but the profits were actually going in the opposite direction. Enron was losing billions of dollars in natural gas projects around the world. For example, the Dabhol project in India was Enron’s largest international endeavour which fell to ruin when the Indian government realized that they could not afford to buy the electricity. But this did not stop the executives at Enron from writing down the future profits for the project into their books.

Enron soon began trading bandwidth when the Dot-com bubble was in full swing. They made a deal with Blockbuster to provide streaming services but the deal fell because the technology simply wasn’t good enough; They still wrote $53 million in their books for it. Next, Enron started trading weather. They started selling futures on weather essentially gambling what the temperature would be. It was activities like these that led Enron to being listed on the Fortune 500’s Most Innovative Companies list.

So, Enron actually suffered huge losses, but how did they hide the debt? Enter Andrew Fastow. He made Enron’s debt disappear by moving them to shore companies. Hence, the debt was still there but it wouldn’t appear on Enron’s financial reports and thus was non-existent as far as investors and creditors can tell.

Enron had also acquired access to the Californian grid after merging with the Pacific Gas and Electric Company. The state had double the capacity than there was demand but strangely rolling power outages became common. This was because Enron traders were manipulating the newly deregulated electricity market. They would move the electricity out of the state to increase demand and when the price got high enough, they would move it back in squeezing every last dollar from the Californians.

Enron’s fall began when Jeffrey Skilling suddenly resigned on August 14, 2001. The pressure was getting to the executives and within two months the company went from the healthy appearance of one of the foremost innovators to complete bankruptcy. Criminal investigations were launched. Arthur Anderson, America’s oldest accounting firm was found guilty of obstructing justice. Arthur Anderson was Enron’s accounting firm and so it was their job of auditing Enron’s financial reports. Arthur Anderson was subsequently dissolved due to the loss of reputation.

Kenneth Lay, Jeff Skilling and Andrew Fastow were all found guilty. There were several other people involved in the scandal many of which walked away with millions of dollars and sold their stock right before the massive drop. At that time this was the biggest corporate bankruptcy in American history. The company paid more than $21.7 billion from 2004 to 2011 to its creditors. This scandal along with many other scandals at the time dramatically changed the accounting industry and ultimately led to the enactment of the Sarbanes-Oxley act of 2002.

Comments