The Ruble, no longer 'in rubble'?

- Ayush Bhupal

- May 1, 2022

- 3 min read

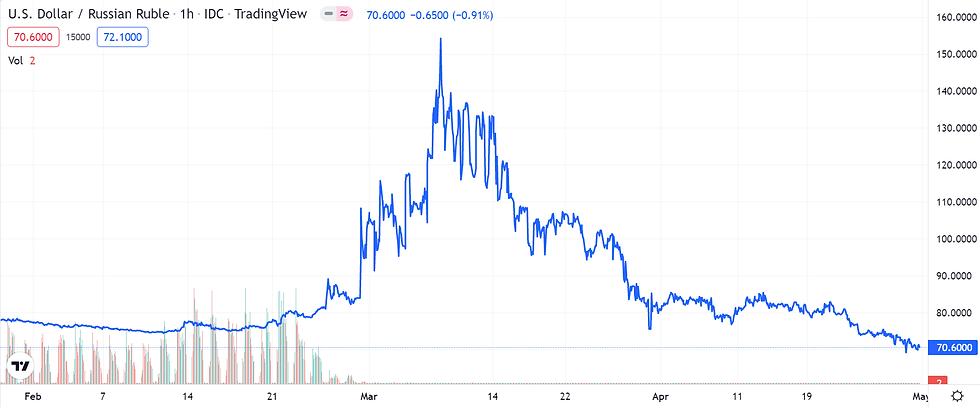

The Russian currency has made a remarkable comeback from that low point on March 7. It was trading at 71 to the dollar at the time of writing, which is precisely where it was before the invasion. This isn't a dead cat bounce, either. The Ruble was the world's best-performing currency in March thanks to a fast and sustained comeback. All of the sanctions established at the start of the war are still in effect, and in some cases, they've been strengthened. So, how did the Russians bring their currency back to life?

The goal of the financial restrictions is to urge Russia to stop the war and avoid a disastrous impact to the economy. So, why has it recovered so quickly? Following the invasion of Ukraine, Russia imposed a number of restrictions on trade in the ruble, including the following:

28th Feb – Russian authorities announced that all companies that were exporting products from Russia had to convert 80% of all of their foreign currency back into rubles. This policy is forecasted to bring over $400 billion back into the Central Bank of Russia. It practically supports the ruble; the policy is intended to increase demand for the ruble by allowing more rubles to circulate in the Russian economy instead of dollars.

1st Mar – Putin banned cash exports from Russia exceeding $10,000 in value. This was implemented to ensure that any foreign currency held in Russia at the time was not moved overseas. This was yet another tactic to get Russians to use rubles rather than dollars.

3rd Mar – Russia imposed a 30% commission on forex purchases by individuals. Inflation in Russia is now hovering at 17%. Transferring rubles into other currencies is more expensive due to the 30% charge. This ensures that citizens remain loyal to the ruble and do not change it to any other currency.

8th Mar – Russia introduced an outright ban on the sale of foreign currencies for a 6-month period. If you can't sell a currency, the only trades you can do are purchases of that currency, which directly supports the value of the ruble. It is no coincidence that the value of the ruble has surged dramatically since the ban was implemented. It is currently trading at the same level as it was before the war. However, there is another aspect to this recovery.

The blue line represents the exchange rate (Russian ₽ against the US $) while the bar chart depicts the volume of trades. There was a huge drop in volumes and a massive surge in the exchange rate as soon as the invasion began (February 24th) which is logically explained by the sanctions. After the 7th of March, the bar chart basically vanishes, which does not however correlate with the recovery in the exchange rate. Because there is no longer any volume trade in the ruble, this means that the international markets have effectively closed. The majority of the Western world no longer buys Russian commodities, thus they have no need to purchase rubles. Because the volume of trades is so small, it is very easy to manipulate the exchange rate. As a result, the exchange rate is no longer representative of what we have seen in the past.

So, does the bounce back prove that the sanctions are not working? No.

We have a highly distorted market. The majority of corporations and countries do not need to buy rubles because they do not require them. The external demand for rubles has plummeted to a new low. As a result, the Russian government is manipulating the market for rubles and manufacturing demand that would otherwise not exist. According to some observers, Russia has essentially created a Potemkin currency. The cumulative effect of the sanctions is to obliterate Russia's international trade. They are still exporting oil and gas in international markets, but imports into Russia are essentially non-existent. It remains to be seen when this façade will collapse.

So informative! Very well articulated.